- Powell says Fed could cut ‘as soon as’ September meeting

- Treasury yields dropped to lowest since February after Fed

https://imasdk.googleapis.com/js/core/bridge3.655.0_en.html#goog_2018625971UnmuteWATCH: Former St. Louis Fed President Bullard says he expects the central bank to start cutting interest rates in September.Source: Bloomberg

Gift this article

Have a confidential tip for our reporters? Get in TouchBefore it’s here, it’s on the Bloomberg Terminal LEARN MORE

By Divya Patil and Winnie Hsu

July 31, 2024 at 3:40 PM PDT

Updated on

European and US equity futures advanced on Thursday after the Federal Reserve signaled it’s close to cutting rates in September. Oil climbed for a second day on Middle East tensions.

Contracts for the Euro Stoxx 50 rose 0.3%. US stock-index futures climbed 0.6%, adding to gains on Wall Street. Investors are now watching Bank of England’s interest rate decision, the third major central bank meeting in two days. The monetary authority is expected to cut rates by 25 basis points, according to consensus forecasts compiled by Bloomberg, which would be the first reduction since the start of the pandemic.

In Asia, Japanese stocks tumbled by the most since 2020, with the yen rallying as traders braced for further rate hikes by the Bank of Japan. The diverging fortunes reflected traders’ positioning for the narrowing of US-Japan rates differentials after the two central bank decisions on Wednesday.

After raising rates, BOJ Governor Kazuo Ueda said more increases will come if its price forecasts are met. Japan’s Topix index slid almost 4% before paring, as the yen touched 148.51 against the dollar, its strongest level since March. The currency has gained almost 8% in the past month.

“The volatility of the yen has risen since the shifting Fed expectations after US CPI numbers on July 10,” said Societe Generale strategist Frank Benzimra. “The BOJ hike decision yesterday amplified the volatility. We see some carry trade starting to reverse. We are at inflection points. It doesn’t mean the end of the Japan bull market, but a pause, and importantly some shift back to domestic sectors.”

A Bloomberg index of dollar strength had its worst day since May on Wednesday, supporting a rally in emerging markets and Asian currencies. The Malaysian ringgit strengthened to levels not seen in almost a year against the dollar, while the Thai baht traded at a four-month high.

Get Caught Up on What’s Important.

Sign up for the Evening Briefing, Bloomberg’s flagship global daily newsletter

Sign Up

“Most of the Asian currencies are likely to gain against the US dollar in the short term,” said Tomo Kinoshita, global market strategist at Invesco Asset Management Japan. “Given the volatility caused by the prospect of prolonged higher rates in the US from the start of this year, Asian markets had suffered from currency depreciation pressures, which prevented many Asian central banks from initiating rate cut moves.”

Treasuries fell in Asian trading to partly unwind a Wednesday rally, where yields tumbled some 10 basis points or more across the curve on Fed rate cut hopes. Australia and New Zealand yields fell Thursday, tracking gains for Treasuries in the prior session. Gains for US debt also reflected reports that Iran had ordered retaliation against Israel for the killing of a Hamas leader on its soil.

The report pushed Brent crude to break through $81 a barrel mark after jumping 3.6% in the previous session. Gold steadied just below a record high.

In Europe, BMW AG earnings declined in the second quarter on waning sales in its key market China, while ArcelorMittal SA reported a fall in profit and cautioned that excessive exports from China left the steel market in an unsustainable position.

Federal Reserve

The changes in the Fed statement solidify a shift in tone among several policymakers, including Powell, recognizing growing risks to the labor market. They are also likely to reinforce expectations among economists and investors for a rate cut at the central bank’s Sept. 17-18 gathering.

“Powell’s comments last night were definitely positive for risk assets as they strongly hinted at a cut in September,” Pauline Chrystal, a fund manager at Kapstream Capital in Sydney. “With the US economy still resilient and confidence that inflation is returning to target, it pushes further out the risk of a recession.”

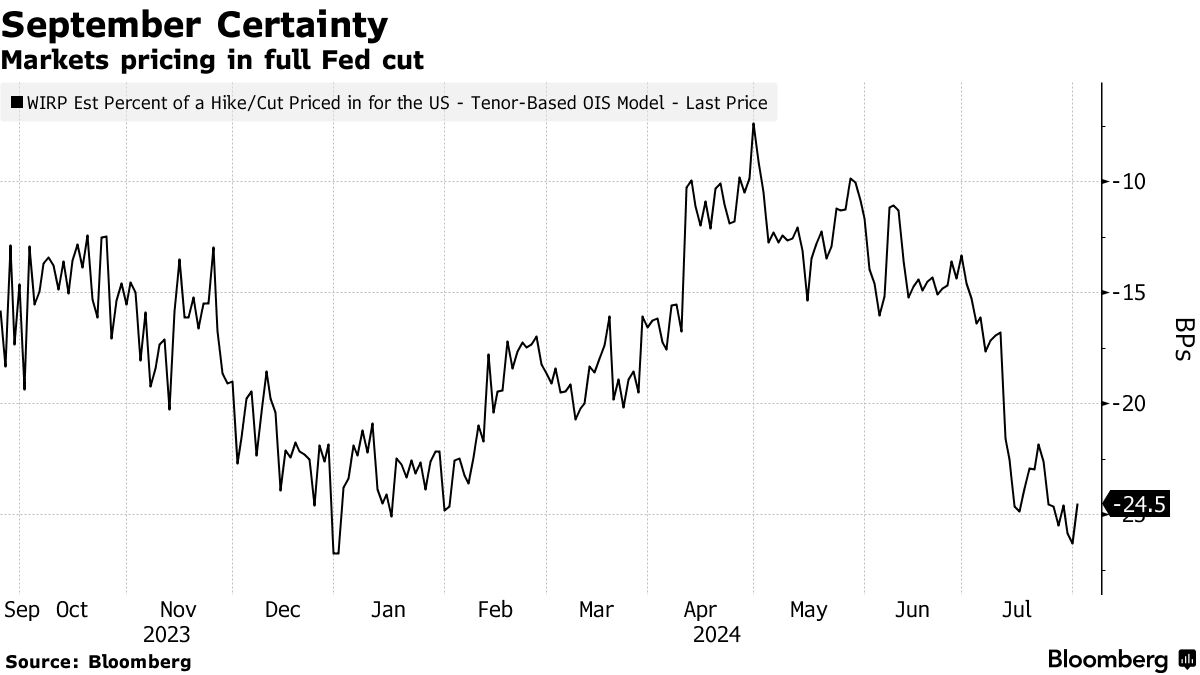

Interest-rate swaps showed traders are still fully priced in a quarter point cut in September — and a total of almost 70 basis points worth of reductions for the year.

“The data has moved in Powell’s direction and now he’s getting ready to follow,” said David Russell at TradeStation. “Jobs data on Friday and CPI in two weeks are the next big items. If those go well, we could get clearer messaging from Powell at Jackson Hole in late August.”

| Take the MLIV Pulse survey |

|---|

| When the Fed eventually starts cutting, will that help or hurt your finances? Share your thoughts. |

1:32WATCH: While speaking at a rally in Pennsylvania, Donald Trump said “seniors should not pay taxes on social security.” The former US president’s pledge would reduce levies for some elderly Americans but further strain benefits for those who have yet to retire.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

- US initial jobless claims, ISM Manufacturing, Thursday

- Amazon, Apple earnings, Thursday

- Bank of England rate decision, Thursday

- US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.6% as of 6:45 a.m. London time

- Nikkei 225 futures (OSE) fell 2.9%

- Japan’s Topix fell 3.2%

- Australia’s S&P/ASX 200 rose 0.4%

- Hong Kong’s Hang Seng rose 0.2%

- The Shanghai Composite rose 0.1%

- Euro Stoxx 50 futures rose 0.3%

- Nasdaq 100 futures rose 0.9%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0829

- The Japanese yen was little changed at 149.90 per dollar

- The offshore yuan fell 0.1% to 7.2344 per dollar

- The Australian dollar fell 0.2% to $0.6530

- The British pound was little changed at $1.2849

Cryptocurrencies

- Bitcoin fell 0.5% to $64,267.13

- Ether fell 1.2% to $3,181.52

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.06%

- Japan’s 10-year yield was little changed at 1.040%

- Australia’s 10-year yield declined three basis points to 4.08%

Commodities

- West Texas Intermediate crude rose 0.9% to $78.63 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

— With assistance from Richard Henderson