- Central bank pushes rates to 0.25%, highest since Dec. 2008

- Pace of bond-buying will be halved over a two-year period

WATCH: Bloomberg’s Shery Ahn reports from Tokyo on the BOJ’s rate decision.Source: Bloomberg

The Bank of Japan raised its benchmark interest rate and unveiled plans to halve bond purchases, underscoring its determination to normalize monetary policy.

The BOJ hiked its policy rate to around 0.25% from a range of 0 to 0.1%, according to a statement on Wednesday. It also said it would reduce its monthly pace of bond buying to around ¥3 trillion ($19.9 billion) by the first quarter of 2026. The recent pace of purchases has been about double that amount.

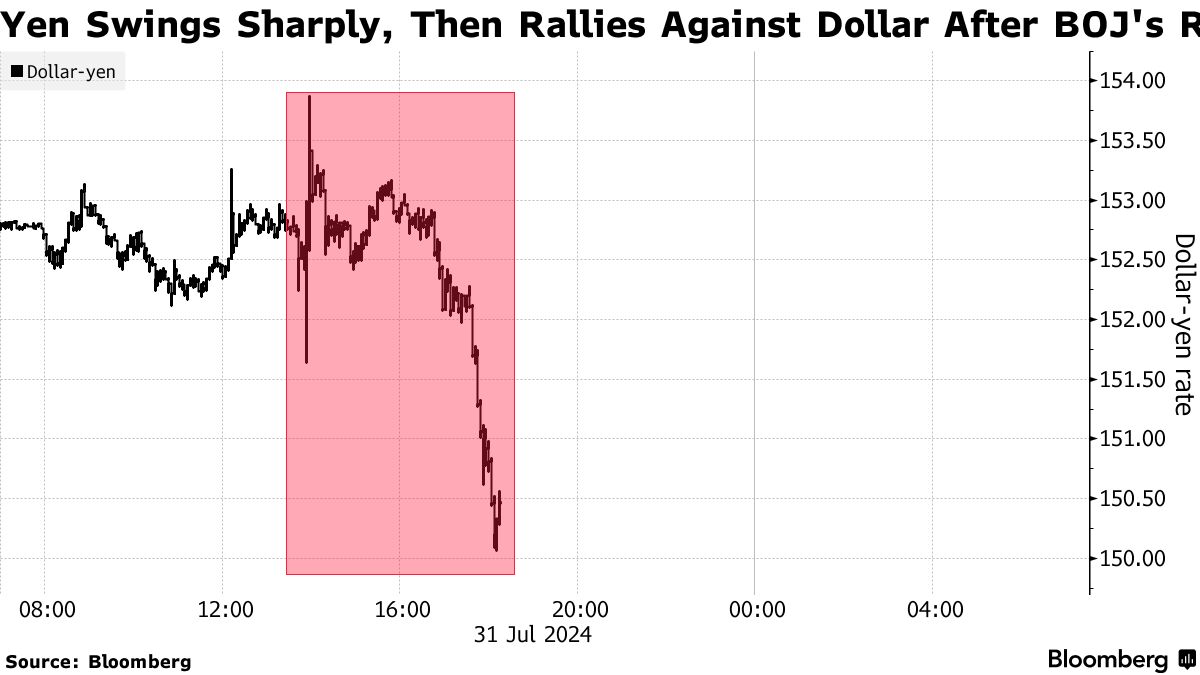

The yen strengthened more than 1.5% against the dollar and equities advanced after the decision, led by a surge of almost 5% in a gauge of bank stocks. The yield on 10-year government bonds rose 6 basis points to 1.055% and yields on two-year notes hit a 15-year high.

While only about 30% of BOJ watchers predicted a hike as their base-case scenarios, almost everyone saw the risk of a July move, according to a Bloomberg survey. The high degree of uncertainty leading up to the meeting kept the yen and Japanese stocks on a roller coaster ride in recent days.

The BOJ’s decision showcased Governor Kazuo Ueda’s determination to proceed with normalization after years in which the central bank pursued an ultra-easy policy that included the world’s last negative interest rate until March. Wednesday’s actions fueled speculation that one more hike may come this year.

| Read more: |

|---|

| BOJ Probes Website Crash That Blocked Traders Before DecisionBOJ REACT: Ueda Puts Policy Normalization Over Growth FearYen Gains After BOJ But Outlook Remains Uncertain, Analysts Say |

Ueda said at a press conference that any additional hikes this year would be data dependent and would be undertaken only after considering the impact of today’s move as well as the March rate increase.

Asked if the BOJ could lift rates beyond 0.5%, Ueda said: “If you’re asking if we view that as a wall, we don’t really have that sense.” He also cited the weak yen as a risk factor for rising inflation. “It’s better to make adjustments as early as possible, even if only little by little,” the governor said, adding that rates remain extremely low in real and nominal terms.

“The BOJ is going through a regime change,” said Hideo Kumano, economist at Dai-Ichi Life Research Institute. “Look at the short period between the March rate hike and this one. That indicates they are trying to get ahead of the curve on inflation, a major shift from its previous stance of lagging behind the curve out of concern over the economy.”

Coming hours before the Federal Reserve is set to meet, Ueda’s hawkish tilt may spell a turning point for the beleaguered yen, as traders position for a narrowing of the US-Japan interest rate gap. It’s rallied more than 7% this month after a dire first half of the year in which it slumped 12% versus the dollar. It traded at 150.12 to the dollar at 5:12 p.m. in Tokyo, the strongest level since March.

Any comments by the Fed hinting at the possibility of a rate cut in September would support the narrative of a shrinking rate gap and likely support the yen. While the BOJ’s interest rate remains low by global standards, it is now at its highest since December 2008.

“This must be one of BOJ’s most hawkish moves given how low it has set the standard,” said Charu Chanana, head of currency strategy at Saxo Capital Markets. “Still, pressure on the yen will likely continue if the Federal Reserve stays away from a clear indication of a September rate cut later today.”

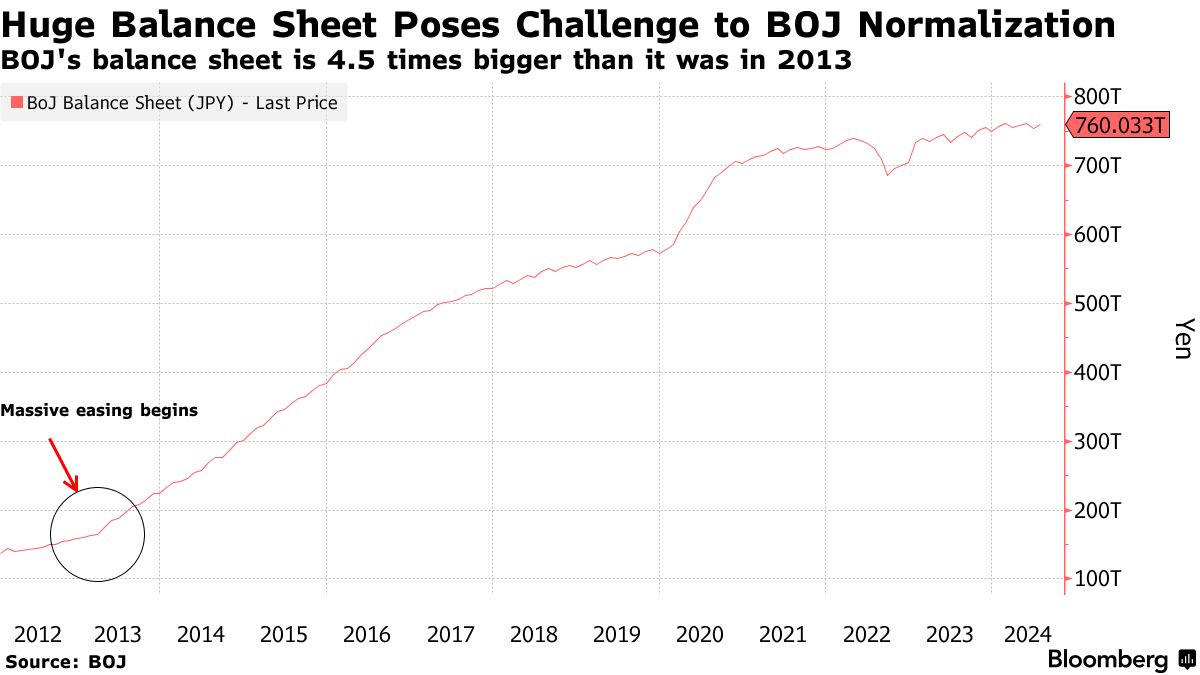

With its plans to cut bond buying, the BOJ is embarking on the path to quantitative tightening after a prolonged period of asset purchases left it holding more than half of the nation’s outstanding bonds, with an even bigger proportion of the market for tenors of 10 years and shorter.

The initial pace of cuts to bond buying was a touch slower than some expectations but the plan looks more aggressive than other market forecasts for a halving of purchases over a two-year period. The BOJ expects its government bond holdings to decrease by 7% to 8% in about two years, Ueda said.

“I think the chance of another rate hike this year has risen,” said Atsushi Takeda, chief economist at Itochu Research Institute. “October or December is possible.”

In an updated quarterly inflation outlook, the BOJ kept its forecast for a gauge of core inflation roughly unchanged, predicting price growth will stay around 2% for the entire projection period through March 2027.

The forecast for the current fiscal year ending in March 2025 was nudged down to 2.5% from 2.8% to reflect the resumption of government energy subsidies. That fed into a bumping up of the following year’s projection to 2.1% from 1.9%, while the fiscal 2026 view remained unchanged at 1.9%.

Ueda reiterated his stance that a rate increase would be warranted as long as the likelihood of meeting the BOJ’s price outlook rises.

What Bloomberg Economics Says…

“The Bank of Japan’s surprise rate hike – which matched our out-of-consensus call – suggests Governor Kazuo Ueda is prioritizing solid inflation numbers over signs of slack demand in the economy, and pressing ahead with policy normalization.”

— Taro Kimura, economist

To read the full report, click here

By raising the rate soon after ruling Liberal Democratic Party heavyweights called for a policy shift, Ueda risks the appearance of having caved in to political pressure.

Toshimitsu Motegi, secretary general of the LDP, and Taro Kono, digital minister, recently urged the BOJ to tighten policy to support the yen and temper inflation, in a sign of their growing frustration over the yen’s role in driving up costs of living.

Approval rates for Prime Minister Fumio Kishida’s cabinet have suffered with inflation being a primary complaint. The cost of living has risen at a clip matching or exceeding the BOJ’s 2% target for more than two years, prompting households to tighten their budgets. Consumer spending dropped every quarter in the 12 months through March.

Big Take Asia

The Lost Art of Raising Prices in Japan

16:19

In the runup to this week’s meeting, some BOJ officials were of the view that standing pat was an option while they await more data in hopes of seeing signs of resurgent consumer spending, people familiar with the matter told Bloomberg earlier this month. The vote in favor of Wednesday’s rate hike was a 7-2 majority.

It’s unclear how Japanese households shouldering housing loans will react to the prospect of potentially higher payments. About 70% of the loans are tied to a floating rate, according to a government report. Savers may also see a higher return on their bank deposits.

“The BOJ has pulled off another mini masterstroke in its approach to changes in monetary policy, and again its ability to communicate important changes to the market, and not cause any tightening in financial conditions,” said Chris Weston, head of research at Pepperstone Group Ltd. “While they have an incredible challenge ahead of them, the BOJ are managing the situation admirably.”